Say hello to AI-driven automated chargeback management that reduces human error and presents tailored evidence per reason code, issuer, card scheme, and more.

Justt is the world’s first smart chargeback solution that tailors each response and improves over time. Unlike template-based solutions, it uses AI-powered automation and domain expertise to generate dynamic arguments, customizing each response, no matter the volume or complexity. With a machine learning engine that's continuously running A/B tests in the background, Justt is the only chargeback solution that self-improves over time—helping merchants win more disputes effortlessly.

| Simple integration Get started instantly, with or without sharing customer data. Use dozens of integrations with leading PSPs and upload data through API or CSV. |

Fully self driving Respond to chargebacks in seconds, without lifting a finger, at any volume and any complexity - including during seasonal surges and volume fluctuations. |

500+ data points Justt collates all relevant merchant data, 3rd party enrichment (for evidence such as proof of delivery), and PSP data. No screenshots required! |

| Dynamic arguments Data is pulled from multiple data sources, and Justt automatically chooses the best evidence and arguments to provide a tailored response for each specific chargeback. |

AI-powered optimization Justt runs continuous A/B testing for every element in a representment in order to improve your win rates over time. |

Domain expertise Justt’s core algorithms are continuously informed by the experience of our in-house experts and analysts, based on past results and changes in industry rules and regulations. |

|

|

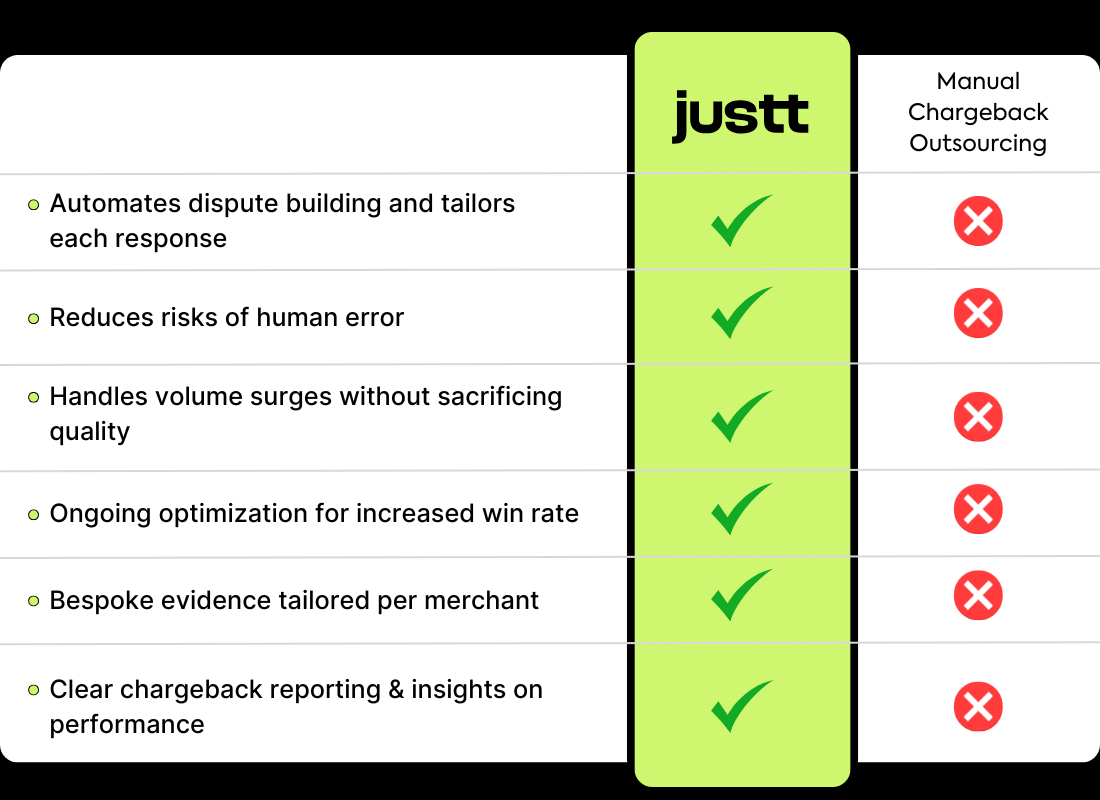

Manual Chargeback Outsourcing | |

|---|---|---|

| Automates dispute building and tailors each response |

|

|

| Reduces risks of human error |

|

|

| Handles volume surges without sacrificing quality |

|

|

| Ongoing optimization for increased win rate |

|

|

| Bespoke evidence tailored per merchant per case |

|

|

| Clear visibility on chargeback performance |

|

|

Chargebacks have a business-wide impact on merchants. From manpower, ever-changing rules and regulations to direct and indirect costs, chargebacks can undermine your business' vitality and compromise your financial trajectory.

Justt harnesses the power of AI, machine learning, and deep domain knowledge. Our platform protects your revenue by enhancing your win and recovery rates over time, and at scale, amidst nuances with PSPs such as Buy-Now-Pay-Later providers.